The Chinese leader said his country will invest huge sums of money, reportedly US$1 trillion, in the United States.

By turning the sparring superpowers into business partners, a co-operative future becomes a real possibility—the opposite of Joe Biden’s failed “de-coupling” project. But, as always, there’s a minefield of challenges to get through first.

Details of China’s proposal were apparently laid on the table during private talks between the two nations in Madrid in September—but public details are slowly emerging, including in a Bloomberg report quoting sources on Friday.

.Here are six things worth knowing.

1. A BIG WIN FOR TRUMP, TOO

First, if this goes ahead, Donald Trump gets a large chunk of Chinese money spent in the US.

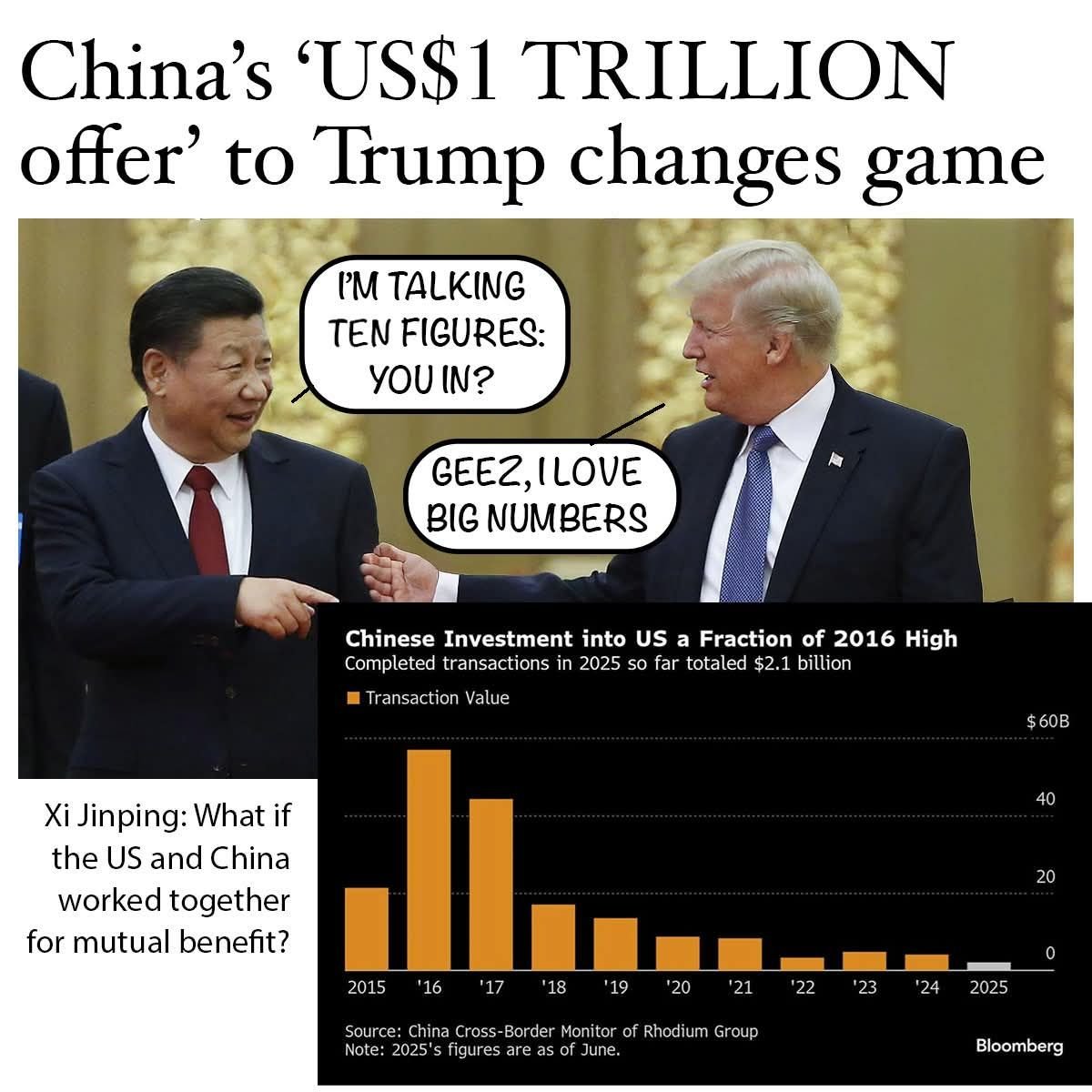

The exact figure is not being specified, but China earlier this year talked about potential investment of US$1 trillion. This would have to be over multiple years. The previous single year Chinese investment was US$57bn in 2016.

The money would not be a grant but would have to create returns for China. The Chinese have been quite smart about creating profitable international businesses – see BYD and Shein as examples.

With EU and Japan also investing, this would be seen in the US as a huge win for the US President.

.2. NO MORE ‘NATIONAL SECURITY’ INSANITY

On its part, the US would roll back its ludicrous list of items that are considered Chinese “national security risks”. (It would have to do this anyway, so that investments could take place.)

This would directly benefit both American and Chinese businesses. Many US businesses have been prevented from accepting desperately needed Chinese investment by China hawks. One of the most hyperactive fearmongers, David Feith of the National Security Council, was recently sacked.

And, from China’s point of view, many Chinese businesses have diversified their export markets but still want the rich US on their customer lists.

.3. TARIFF TEAMWORK

The Chinese also made an innovative offer on tariffs. If China builds factories in the United States, employing American citizens, the operations will still need vast amounts of parts and raw materials.

The items that come from China must have greatly reduced tariffs. Again, this would be a boost to Chinese businesses too.

.4. SHARING TIKTOK

A fourth element discussed was a shared ownership deal on US TikTok—which has already gone into operation.

Analysts said that the TikTok deal, with the US controlling a Chinese entity’s operations within American borders, could be used as a model for other deals.

Ironically, the US-controlled TikTok now seems to be in some ways more politically censored than it was when it was controlled by China, according to some reports.

.5. SLIGHT CHANGE ON TAIWAN

A fifth element is a tiny change of emphasis in the wording of US policy on Taiwan, according to a source spoken to by the Wall Street Journal.

Like the rest of the world, the US recognizes Taiwan as a legal part of China, and US official policy says it “does not support” any bid for independence. This would be edited to say it “opposes” independence—no difference in practice but a free-of-charge way for the US to look helpful.

.6. RELATIONSHIP CHANGES

Most importantly, the relationship changes. Both sides are already making positive noises about co-operation. Analysts noted that in a phone call last month, President Xi urged President Trump to create conditions for “Chinese enterprises to invest” in his country.

For both China and the United States, domestic economic concerns can be alleviated by a rise in business activity.

But there are also challenges. Years of crude demonization by the press means that individual states, like Florida, have their own anti-China policies. Also, the bad relationship between the White House and certain states could be a barrier to success.

.DON'T MENTION THE WAR

And the “peace through strength” policy that oversees a build-up of US preparations in East Asia for a war on China is a problem, too.

At the moment, the Trump administration is pulling in two different directions, with some elements making active preparations for war while others want to tie the US and China more tightly together to boost business.

Continuing in both directions will split the administration. So what’s going to happen? Given Donald Trump’s unpredictability, no wise analyst is going to forecast the future.

But a deal could be made quickly. Diplomats say Trump is likely to meet Xi at or before the next Asia-Pacific Economic Cooperation summit. This takes place in South Korea from October 30 to November 1.

It could be a happy Christmas for the world’s two biggest economies. Even if preparations for war continue in the background.

Author: Saikat Bhattacharya